unfiled tax returns 10 years

Often they go back many years longer than the IRS. The act of not filing ones tax returns is a crime.

Unfiled Tax Returns Law Offices Of Daily Montfort Toups

You can possibly face imprisonment for a length of time proportional to each year of the unfiled tax return.

. Ad Get On a Path Back to Good Standing Get On With Life. There is no statute of limitations on a late filed return. 4506-T is a Request for Transcript of Tax Return and will provide you with your wage and income.

Get free competing quotes from the best. See if you Qualify for IRS Fresh Start Request Online. 12000 for single filers or married filing separate returns.

If your return wasnt filed by the due date including extensions of time to file. How Many Years Does the IRS Go Back for Unfiled Tax Returns. We Help You Negotiate the Lowest IRS Payment Amount Allowed By Law.

If You Dont File Your Return the IRS May File a Return for You. Included with all TurboTax Free Edition Deluxe Premier Self-Employed TurboTax Live TurboTax Live Full Service customers and access to up to the prior seven years. Ad 4 Simple Steps to Settle Your Debt.

Ad Our Licensed CPAs Attorneys IRS Enrolled Agents Are Here to Help You Achieve Tax Relief. Keep business income tax returns and supporting documents for at least seven years from the tax year of the return. While the IRS does not put a bulk of.

If you need to catch up on filing taxes our software can help. 0 Fed 1799 State. Owe IRS 10K-110K Back Taxes Check Eligibility.

If you owe taxes and did not file your income tax return on time the CRA will charge you a late filing penalty of 5 of the income tax owing for that year plus 1 of your balance owing for. This penalty applies the first day you are late and it can get up to 25 of the. Owe IRS 10K-110K Back Taxes Check Eligibility.

Voluntary Disclosure if More than 10 years Outstanding Calgary Tax Lawyer Analysis. The IRS can legally pursue you for unpaid taxes 10 years after filing your return and taxes being assessed. The six year enforcement period for delinquent returns is found in IRS Policy Statement 5-133 and Internal Revenue Manual 1214118.

For the 2018 tax year these amounts were as follows. Tax will be assessed and youll receive a notice demanding payment. Ad Owe back tax 10K-200K.

In most cases the IRS requires the last six years tax returns to be filed as an indicator of. Sort out your unpaid tax issues with an expert. Ad Use our tax forgiveness calculator to estimate potential relief available.

However in practice the IRS rarely goes past. Part of the reason the IRS requires. The IRS can audit your return and you can amend.

IRS and states will usually come up with much higher balances than you. Here are 10 things you should know about getting current with your unfiled returns. 24000 for married taxpayers filing.

State tax returns not filed for more than 20 years. See if you Qualify for IRS Fresh Start Request Online. The IRS can go back to any unfiled year and assess a tax deficiency along with penalties.

After May 17th you will lose the 2018 refund as the statute of limitations. Once the SFR is filed your problems are just beginning. The CRA voluntary disclosure program VDP only applies to the last 10 years of tax issues such as.

This is called a substitute for return SFR. Submit form 4506-T to the IRS and check the box on number eight. Start Resolving IRS Issues Now.

In most cases the IRS goes back about three years to audit taxes. Expect the IRS to then take the following actions. Ad Owe back tax 10K-200K.

415 38 votes. We Can Help Suspend Collections Wage Garnishments Liens Levies and more. Furthermore many members of our staff.

Delinquent Return Refund Hold program DRRH. Ad Dont Face the IRS Alone. At Tax Resolution Services our Enrolled Agents have decades of combined experiences helping taxpayers get current with their unfiled tax returns.

Get a Free Quote for Unpaid Tax Problems. A copy of your notices especially the most recent notices on the unfiled tax years. For example if an individuals 2018 tax return was due in April 2019 the IRS acts within three years from the.

If you owe tax the IRS will impose a failure-to-file penalty for 5 of the tax owed per month that you are late. Bring these six items to your appointment. Systemically holds an individual taxpayers income tax refund when their account has at least one unfiled tax return within the five years.

18000 for head of household filers. Any information statements Forms W-2 1099 that you may. Before May 17th 2022 you will receive tax refunds for the years 2018 2019 2020 and 2021 if you are entitled to them.

If you havent filed tax returns the IRS may file for you. We provide Immediate IRS Help to Stop Wage Garnishment and End Your Tax Problems. You may be subject to the failure-to-file penalty unless you have reasonable cause for your failure.

Ad Quickly Prepare and File Your Unfiled Taxes.

Unfiled Irs Tax Returns Best Tax Relief Company Is

Unfiled Tax Returns Premier Tax Solutions

Unfiled Tax Returns Archives Irs Mind

10 Or More Years Of Unfiled Tax Return A Guide On How To Resolve It Tax Resolution Professionals A Nationwide Tax Law Firm 888 515 4829

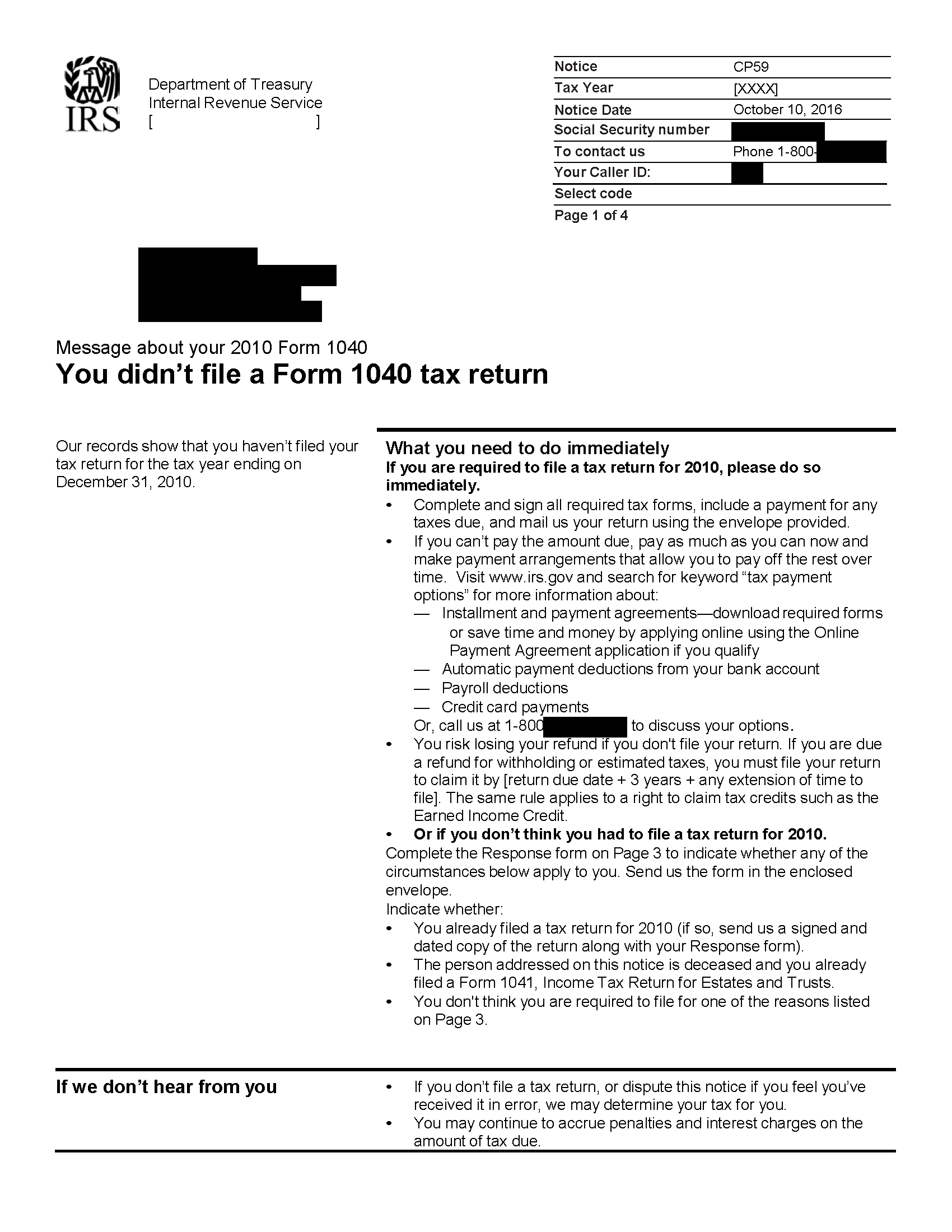

Irs Notice Cp59 Form 1040 Tax Return Not Filed H R Block

Unfiled Tax Returns Notice Of Deficiency J David Tax Law

What Should I Do If I Have Years Of Unfiled Tax Returns Nj Taxes

Unfiled Tax Returns 101 I Peter E Alizio Cpa Esq

What Should You Do If You Haven T Filed Taxes In Years Bc Tax

Unfiled Tax Returns The Law Offices Of Craig Zimmerman

Unfiled Tax Returns Tax Champions Tax Negotiation Services

Unfiled Tax Returns Mendoza Company Inc

It S Been A Few Years Since I Filed A Tax Return Should I Start Filing Again H R Block

I Haven T Filed Taxes In 10 Years Or More Am I In Trouble

Unfiled Tax Returns 101 I Peter E Alizio Cpa Esq

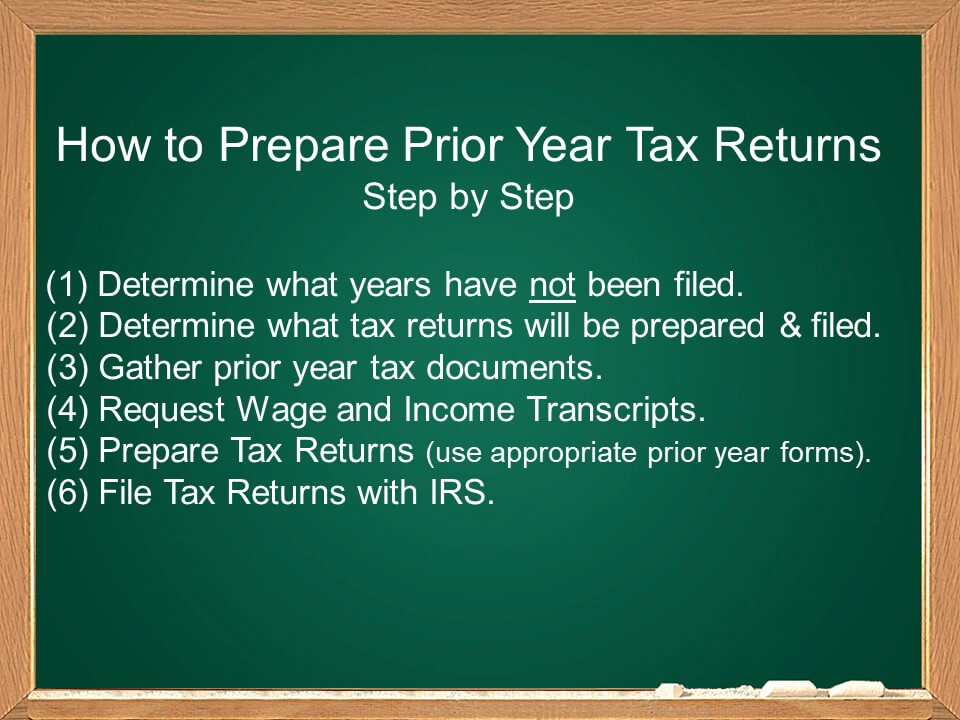

How To File Back Taxes On F J M Q Visas Filing Prior Year Tax Returns

Unfiled Tax Returns 101 I Peter E Alizio Cpa Esq

How Far Back Can The Irs Collect Unfiled Taxes

Scott Allen E A If You Need To File Back Tax Returns In Chandler Az Tax Debt Advisors